- Contractor expenses and tax deductions full#

- Contractor expenses and tax deductions plus#

- Contractor expenses and tax deductions professional#

This is different from other self-employed individuals not within the construction industry, who normally receive their payments gross, which means no tax is deducted. The CIS rules mean that the contractor is usually obliged to withhold tax on its payments to you, at either 20% if you are ‘registered’ or 30% if you are not. The CIS is a HMRC scheme which applies if you work for a contractor in the construction industry but not as an employee, so for example as a self-employed individual. Quarterly payments are also due by June 15, September 15 and January 15.įor more information about the tax obligations and breaks for people with freelance or other self-employed income, see Self-Employed Individuals Tax Center (opens in new tab) and see IRS Publication 334 Tax Guide for Small Business (opens in new tab).What is the Construction Industry Scheme (CIS)? The first payment is due Ap(see IRS Form 1040-ES (opens in new tab) for the form, worksheet and address where you should send the form you need to send it separately from your tax return). If you will continue earning income as an independent contractor in 2017, you may need to file quarterly estimated tax payments. See How Self-Employed Workers Can Save for Retirement to help calculate how much you can set aside in either plan. But you still have time to open and contribute to a SEP, which is similar to an IRA and offered by many brokerage firms, banks and mutual fund companies. It’s too late to open a solo 401(k) for 2016 (you needed to open the account by December 31 but have until April 18, 2017, to make contributions if you already have an account). Self-employed people can make tax-deductible contributions to a solo 401(k) or Simplified Employee Pension based on their self-employed income. See IRS Form 8829 Expenses for Business Use of Your Home (opens in new tab) for more information.

Contractor expenses and tax deductions full#

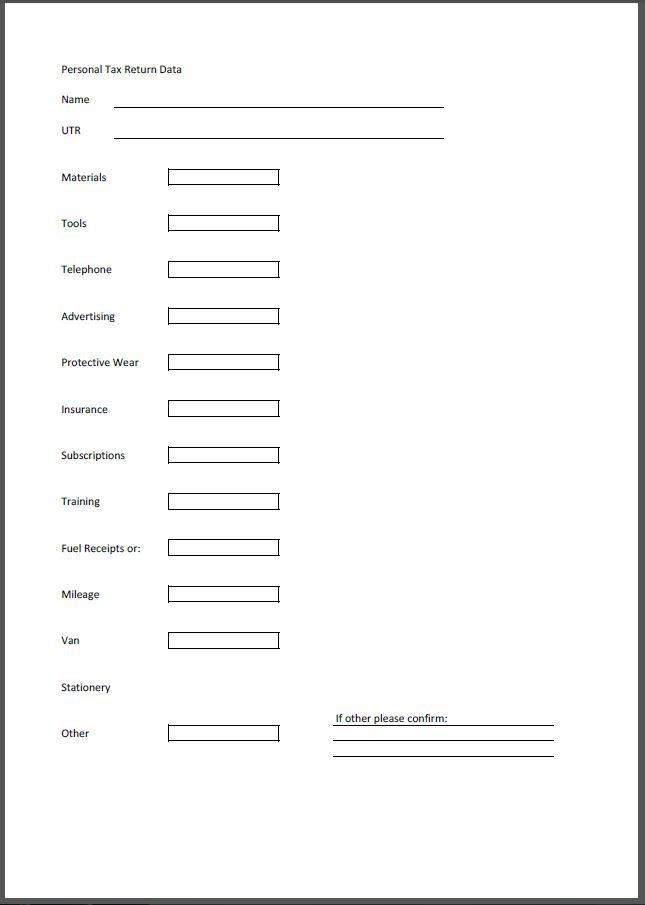

You’ll also be able to deduct the full cost of certain direct expenses for your home office, such as the cost of maintenance and repairs to that part of your home.

For example, if your home office is one-fifth of the square footage of your home, you can deduct 20% of those expenses. Or you can use the regular method, which is based on your actual expenses, deducting a portion of your mortgage interest or rent, utilities, property taxes, homeowners insurance and other expenses based on the percentage of your home you use for your work. If you qualify, you have two options for taking the deduction: You can use the simplified option, which lets you deduct $5 for every square foot in your home that qualifies for the deduction (up to a maximum write-off of $1,500).

See the IRS’s home-office deduction factsheet (opens in new tab) and Publication 587 Business Use of Your Home (opens in new tab) for more information. Independent contractors can deduct the cost of a home office if they use part of their home regularly and exclusively for a freelance business. Half of the Social Security and Medicare taxes you pay is also deductible.

Contractor expenses and tax deductions professional#

You can also deduct legal and professional fees for your business, books and publications you purchase for your business, and the cost to rent an office space (or you may qualify for the home-office deduction if you work regularly and exclusively in your home).

Contractor expenses and tax deductions plus#

The good news for you as an independent contractor is that you can deduct many of your business expenses - such as the cost of a computer, printer and other equipment you use in your work, plus the cost of work-related phone calls and mailings, office supplies, duplicating, advertising and business travel. If your net earnings are more than $400, you’ll also need to file Schedule SE (opens in new tab) to figure your Social Security and Medicare taxes. You may be able to use the shorter Schedule C-EZ (opens in new tab) if your business expenses do not exceed $5,000, you have no employees and you don’t claim a home-office deduction (see below). You’ll need to report that income on a Schedule C (opens in new tab) accompanying your tax return. Answer: You should receive a Form 1099-MISC from your old employer by the end of January reporting your self-employed income for 2016.

0 kommentar(er)

0 kommentar(er)